If you’re a parent, you know the emotional roller coaster a tantrum can be. One minute your child is laughing, and the next, they’re screaming because their toy truck is the “wrong” shade of red.

Most parents see these episodes as exhausting, even maddening. But some, the wise and seasoned ones, learn to see them differently—as a child learning to express themselves, maybe even standing their ground.

Still, let’s be honest. We don’t like tantrums.

And yet—who throws bigger tantrums than our very own equity markets?

Let’s take a quick walk down memory lane:

-

Asian Financial Crisis (1998) – Nifty tanked 23.4%

-

9/11 Terror Attacks (2001) – A shocking 43% crash

-

Global Financial Crisis (2008) – A brutal 57.7% decline

-

European Debt Crisis (2011) – Nifty dropped 26.8%

-

Covid-19 Pandemic (2020) – A swift 38.1% fall

-

And now: Tariff Tantrums (2024-25) – Uncertainty returns

Nobody likes these drawdowns. They create fear, doubt, and the occasional urge to hit “redeem” and run.

But if you’re a disciplined investor, especially someone doing SIPs regularly, here’s the surprising truth:

These tantrums actually work in your favour.

Let me show you how with a simple illustration:

📊 Two Investment Scenarios – Same Destination, Different Journeys

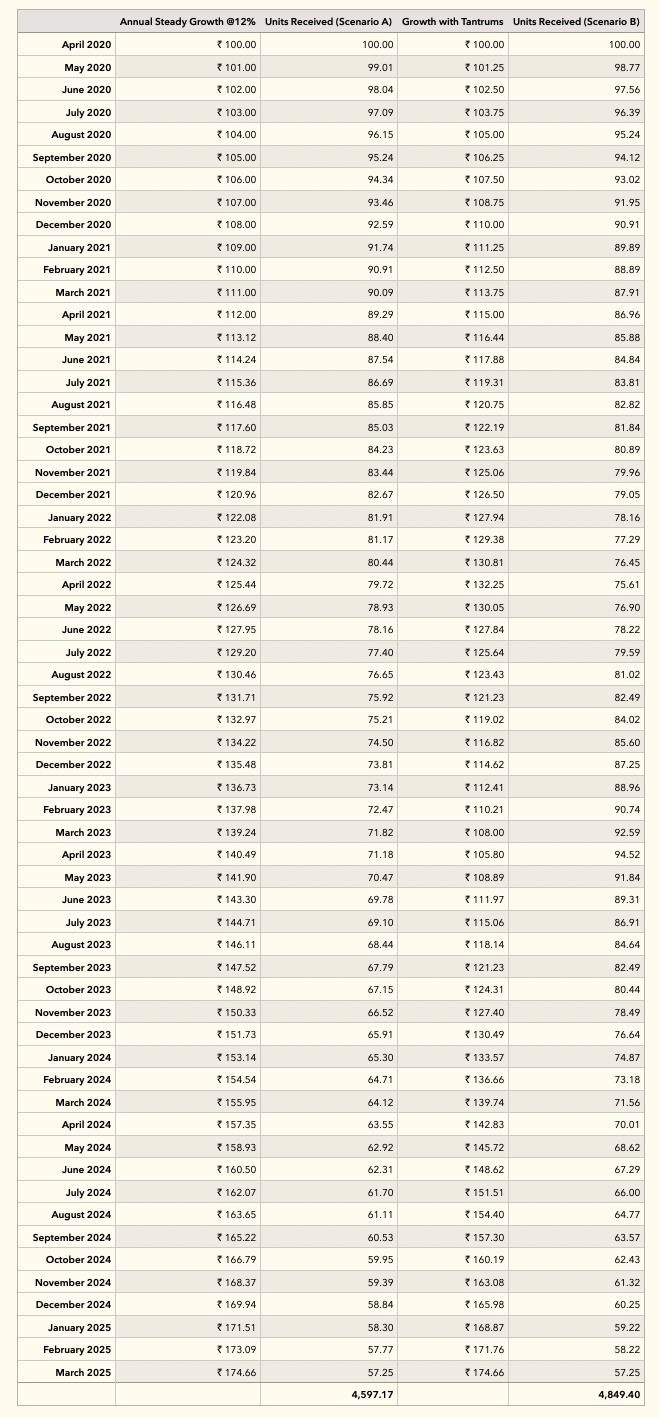

Let’s say you started a SIP of ₹10,000 per month in a mutual fund five years ago. The fund had a starting NAV of ₹100. Here are two different market journeys—both ending at the same NAV of ₹174.66 after five years.

Scenario A: Smooth 12% Growth Every Year

- Steady, no drama.

- You accumulate 4,597 units.

Scenario B: The Tantrum Route

- Year 1: +15%

- Year 2: +15%

- Year 3: -20% crash (the tantrum)

- Year 4: +35% rebound

- Year 5: +24%

Final NAV: Still ₹174.66

But guess what?

Here, you accumulate 4,849.4 units — the highest among all.

(See the comparison in the table below.)

As you can see, volatility didn’t destroy your wealth—it quietly built more of it. The second scenario, despite a nasty third-year fall, actually helped you collect the most units because you were buying more when prices were low.

💡 The Tantrum Teaches a Lesson: Volatility is Your Ally

When markets fall, your SIP buys more units. In the recovery phase, these extra units grow in value, giving your corpus a supercharged boost.

This is Rupee Cost Averaging (RCA) in action—automatically buying low during dips and averaging out the highs. You don’t need to time the market. You just need to stay consistent.

So next time markets throw a tantrum—due to tariffs, geopolitics, pandemics, or plain panic—don’t see it as a headache.

See it as an opportunity.

✅ Key Takeaways

SIPs thrive on volatility: The dips help you buy more; the recovery grows your wealth faster.

Focus on accumulation, not market timing: Let the units pile up—NAV will take care of itself.

Stay the course: Discipline beats drama, every time.

As a parent, you don’t give up on your child during a tantrum. You wait it out, knowing there’s growth on the other side. As an investor, do the same with your SIPs.

Stay calm. Keep investing. Let the magic of rupee cost averaging work for you.

One Comment

Leave A Comment Cancel reply

Join Our Mailing List

Once Weekly Webinar

Free Webinar Once Per Week

Our free webinar runs once per week and is available to anybody who wants to know more about getting started on the road to financial freedom.

[…] 👉 Tariff Tantrums and the Magic of Rupee Cost Averaging […]