Every single day, without us even noticing, our body is fending off an invisible army of viruses, bacteria, and other pathogens. Our immune system—made up of white blood cells like neutrophils, macrophages, and lymphocytes—is constantly scanning for threats and launching attacks to neutralize them. The skin acts as a physical barrier, while deeper inside, organs like the spleen, lymph nodes, and bone marrow work in sync to defend us. Even when we feel perfectly fine, countless micro-battles are happening within, often ending before we show any symptoms. Occasionally, when the immune response kicks in hard, we feel it as a fever, inflammation, or fatigue. But most of the time, this silent war goes on unnoticed—24/7, every single day of our lives.

But Your Money is Fighting a War Too

Do you know that while your body is locked in a nonstop battle to protect your health, your financial well-being is also under constant attack? There’s an invisible enemy quietly chipping away at your money’s strength, day after day. It doesn’t make headlines, but it affects everything—from your morning tea to your retirement dreams. Have you guessed it? Yes, it’s inflation—a slow, silent force that reduces what your money can buy, much like a virus weakening the body from within. And just like you can’t ignore your immune system, you can’t afford to ignore inflation either.

Inflation is Not a Concept. It’s a Memory

Inflation isn’t just a percentage—it’s a lived experience. If you ever ran errands as a schoolkid, you’ll remember this well. Think back to when your mother handed you a crumpled note and asked you to bring a litre of milk, a packet of ghee, or a bottle of Kissan ketchup. The shopkeeper knew you by name, and the prices? So modest, they barely made a dent in that ten- or twenty-rupee note. Onions were sold in kilos—sometimes the price was quoted for 5 kilos at once! Today, in sleek grocery stores, you’ll find the same onions with price tags neatly printed per 100 or 250 grams, as if to soften the sticker shock. Milk costs five times more, desi ghee feels like a luxury, and that Kissan ketchup bottle? Smaller, yet pricier. If you’ve been around long enough, you don’t need a chart to understand inflation. You’ve felt it—one grocery bill at a time.

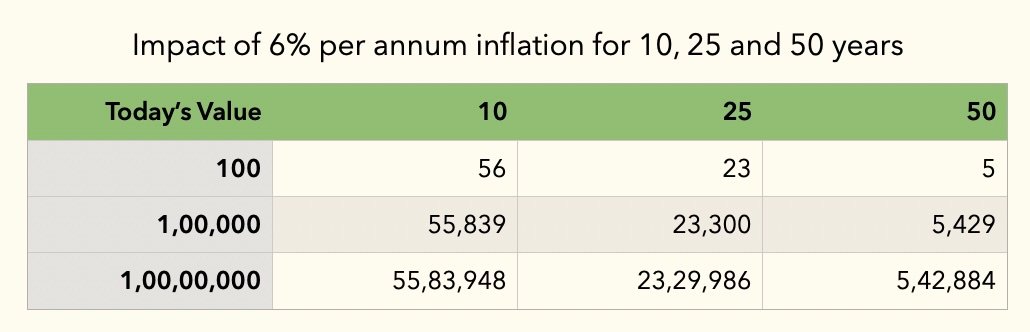

The Rupee is Shrinking—Quietly, Relentlessly

Now, let’s put some hard numbers to this quiet erosion. At just 6% annual inflation, the value of your ₹100 today will shrink to about ₹55 in 10 years, ₹23 in 25 years, and a mere ₹5 in 50 years. Whether it’s ₹1 lakh or ₹1 crore, the story is the same—time and inflation quietly eat away your purchasing power. And here’s the catch: the official inflation numbers you hear on business channels or read in newspapers often understate the real impact. Essentials like food, school fees, healthcare, and transport usually rise faster than the headline inflation rate. That means your money loses value even quicker in the areas that matter most. This isn’t just theory—it’s your daily life playing out in slow motion.

What’s Truly Risky—Volatility or Losing Buying Power?

So, what’s the way out of this slow squeeze? It’s simple—your money must grow faster than inflation. And that means letting it work for you through smart, long-term investments. Equity mutual funds, for example, have historically delivered returns that outpace inflation and build real wealth over time. Yes, markets do move up and down in the short term, and that can feel unsettling. But here’s a question worth asking: What’s truly risky? Watching your portfolio wobble for a few months—or reaching a point where you can’t afford your groceries, your child’s school fees, or your lifestyle in retirement?

Let’s Talk—No Pressure, Just Clarity

You don’t have to figure this out alone. If this message resonated with you—even a little—I invite you to book a free, no-obligation call. Let’s talk about your goals, your fears, and how we can help you build financial immunity, just like your body builds health immunity—one smart move at a time.

Join Our Mailing List

Once Weekly Webinar

Free Webinar Once Per Week

Our free webinar runs once per week and is available to anybody who wants to know more about getting started on the road to financial freedom.