When someone passes away, even something as simple as accessing their bank account or mutual fund investments can become complicated without clarity on nominations, joint ownership, Wills, or Trusts. In this article, we dive into how different assets in India are transmitted to heirs after death—and what documentation is required for a smooth transfer.

✅ 1. Bank Accounts & Fixed Deposits

Scenario: Single holder

-

If there’s a nominee, banks release funds to the nominee after verifying the death certificate and nominee’s ID.

-

However, the nominee is just a trustee, not the legal owner. Legal heirs can still claim a share through court.

If there’s no nominee:

-

Bank may insist on:

-

Succession certificate (if no Will)

-

Probated Will (if Will exists)

-

-

Processing can take 1–6 months depending on clarity of documents.

Scenario: Joint Account

-

If operated Either or Survivor, the surviving holder can continue access.

-

If Jointly operated, it depends on bank policies—usually freezes till transmission.

✅ 2. Mutual Funds

If Nominee Exists:

-

SEBI circular (2022) simplified process for claims under ₹5 lakh:

-

Only death certificate and nominee ID/address proof required.

-

-

If value > ₹5 lakh:

-

AMC may require a Will or indemnity bond.

-

In absence of Will, some AMCs may insist on a succession certificate.

-

Joint holders (if any) take precedence.

-

If No Nominee:

-

AMC will need:

-

Death certificate

-

Notarized indemnity bond

-

Legal heir certificate or succession certificate

-

✅ 3. Demat Accounts & Shares

-

Nominee can get shares transferred after submitting:

-

Death certificate

-

Transmission form (TRF)

-

KYC + PAN of nominee

-

-

If no nominee: Legal heir(s) need to get:

-

Notarized affidavit

-

Succession certificate or probated Will

-

-

Process takes 2–8 weeks

✅ 4. Real Estate (Land / House)

-

No automatic transfer—even if nominee exists.

-

Requires:

-

Death certificate

-

Will (if available) + Probate

-

Legal heir certificate if no Will

-

Mutation of property in revenue records

-

Without a Will, legal heirs may have to go to court, especially if there are disputes. Joint ownership helps, but co-owner still needs to update land records.

✅ 5. PPF (Public Provident Fund)

-

Nominee can claim funds after providing death certificate and ID/address proof.

-

If nominee is a minor, guardian will claim on their behalf.

-

If no nominee:

-

Legal heirs must submit succession certificate

-

-

No joint holding allowed.

✅ 6. EPF (Employees’ Provident Fund)

-

EPFO pays nominee as per Form 2 filled during employment.

-

Claims must be made via employer or online (via Unified Portal).

-

If no nominee:

-

Legal heirs must submit:

-

Succession certificate/legal heir certificate

-

Death certificate

-

Claim form (Form 20)

-

-

-

Processing time: 30–90 days

✅ 7. Life Insurance

-

Nominee files claim with:

-

Death certificate

-

Policy documents

-

Claim form

-

-

Insurance company may do investigation (for early claims)

-

Payment within 30 days if paperwork is in order.

Even here, nominee ≠ legal heir unless named as “beneficial nominee” (per IRDAI rules after 2015).

✅ 8. NPS (National Pension System)

-

Upon death:

-

Nominee gets corpus (lump sum or annuity)

-

-

Documents needed:

-

Death certificate

-

Claim form

-

Nominee ID/KYC

-

-

If nominee is not updated: Legal heir needs succession certificate

✅ 9. Gold, Jewellery & Valuables

-

No formal process unless locked in a bank locker

-

If stored at home, distribution governed by:

-

Will, or

-

Mutual agreement among heirs

-

-

For bank lockers:

-

Bank allows nominee to access contents (under witness) after paperwork

-

If no nominee: Court order or succession certificate required

-

✅ 10. Digital Assets (Email, UPI, Crypto, Subscriptions)

-

No formal laws in India yet

-

Important to:

-

Mention access details in Will or passcode manager

-

Appoint a digital executor

-

-

Without access: families can’t claim data, assets, or cancel subscriptions

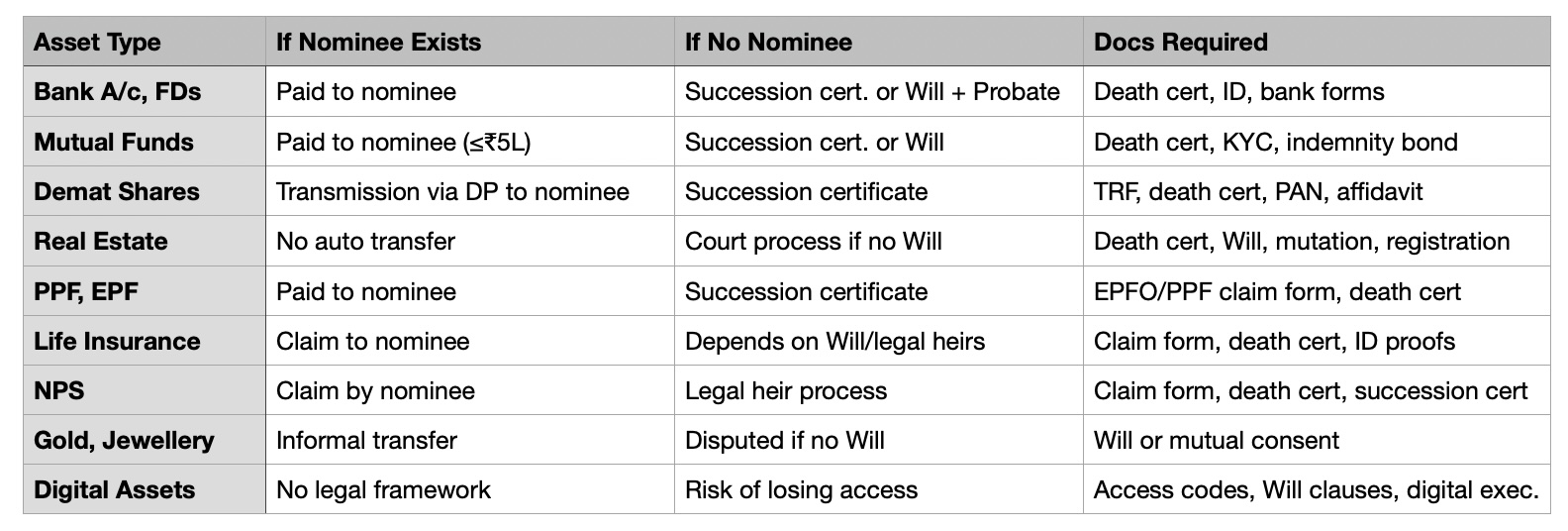

🔁 Summary: Transmission Process by Asset Type

✅ Action Steps

List all your financial + physical assets

Ensure every one has:

-

Updated nomination

-

Clarity in Will

-

Joint ownership, if applicable

-

Talk to family. Keep copies of your Will and asset list safe, but accessible.

Ready to Take the Next Step?

Don’t leave your loved ones with paperwork, confusion, and legal fees. Plan now, and give them peace when they’ll need it the most.

✅ Need help making a Will or understanding how to structure your holdings?

Get in touch via WealthWisher.in/contact-us

Join Our Mailing List

Once Weekly Webinar

Free Webinar Once Per Week

Our free webinar runs once per week and is available to anybody who wants to know more about getting started on the road to financial freedom.