Retirement planning often feels like a distant mountain, far from the everyday hustle. But here’s the catch – the earlier you lace up your boots and start the climb, the smoother and shorter the journey becomes. Let’s dive into why timing is everything and how your choices today shape your tomorrow.

The Dream: ₹1 Lakh per Month in Retirement

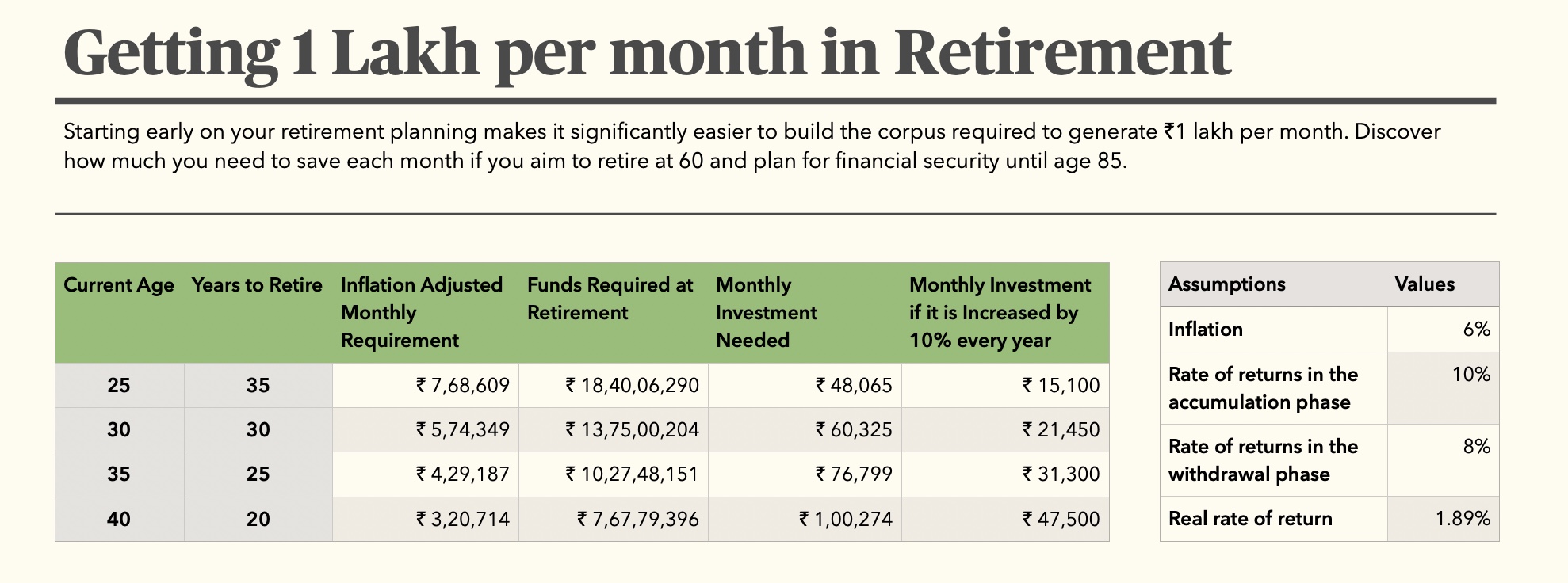

Imagine your retirement: no alarms, no rush hours, just the freedom to live life on your terms. Now, to enjoy ₹1 lakh per month for 25 years post-retirement, you’ll need a corpus of ₹2.26 crore. This amount factors in a 6% annual inflation, ensuring your lifestyle doesn’t take a hit as costs rise.

But here’s where it gets interesting: how much you need to invest depends entirely on when you start.

The Scenarios: What Does Delay Cost You?

Starting at 25: A Stroll in the Park

If you begin your retirement journey at 25, it’s like a leisurely walk. You need to invest just ₹15,100 per month, increasing this amount by 10% annually. With decades ahead of you, compounding does the heavy lifting, turning small, consistent contributions into a robust retirement fund.

Starting at 30: A Gentle Jog

Decided to enjoy your 20s and start saving at 30? It’s not too late, but now it’s more like a jog. You’ll need to invest ₹21,450 per month increasing by 10% annually, nearly 1.5 times what you would have needed at 25. The 5-year delay shrinks your compounding window, demanding a steeper monthly commitment.

Starting at 35: A Strenuous Sprint

Wait until 35, and things heat up. You’ll now need to save ₹31,300 per month stepping up by 10% annually to hit the same target. That’s an extra ₹16,200 per month compared to starting at 25. Compounding needs time, and with less of it, your contributions must bear the brunt.

Starting at 40: Scaling a Cliff

At 40, you’re in for a serious workout. To accumulate the required retirement corpus, you’ll need to invest a staggering ₹47,500 per month topping up by 10% annually. The delay not only tightens the timeline but also magnifies the financial strain, making it an uphill climb.

The Power of Starting Early

Why does starting early matter so much? The answer lies in the magic of compounding. Compounding isn’t just earning returns; it’s earning returns on returns. The longer your money stays invested, the more it multiplies. Think of it as planting a tree – the earlier you plant, the taller and stronger it grows.

For example:

- Starting at 25 gives your investments 35 years to grow.

- Starting at 30 cuts this to 30 years, and at 40, you’re left with just 20 years.

Every year you wait chips away at compounding’s potential, making it harder to achieve the same goal.

A Quick Snapshot of the Numbers

Here’s a table to illustrate the difference starting early makes:

The Takeaway: Don’t Wait for the “Perfect Time”

Life is full of priorities – buying a house, raising a family, traveling the world. But when it comes to retirement planning, time is your biggest ally. The best time to start was yesterday. The next best time? Today.

So, whether you’re in your 20s, 30s, or 40s, take the first step. Begin with what you can and increase your contributions as your income grows. Your future self will thank you.

Ready to Take the First Step?

At WealthWisher, we’re here to guide you on your journey. Let’s create a plan that works for you, no matter where you’re starting from. After all, retirement isn’t about reaching the finish line; it’s about enjoying the view.

Join Our Mailing List

Once Weekly Webinar

Free Webinar Once Per Week

Our free webinar runs once per week and is available to anybody who wants to know more about getting started on the road to financial freedom.