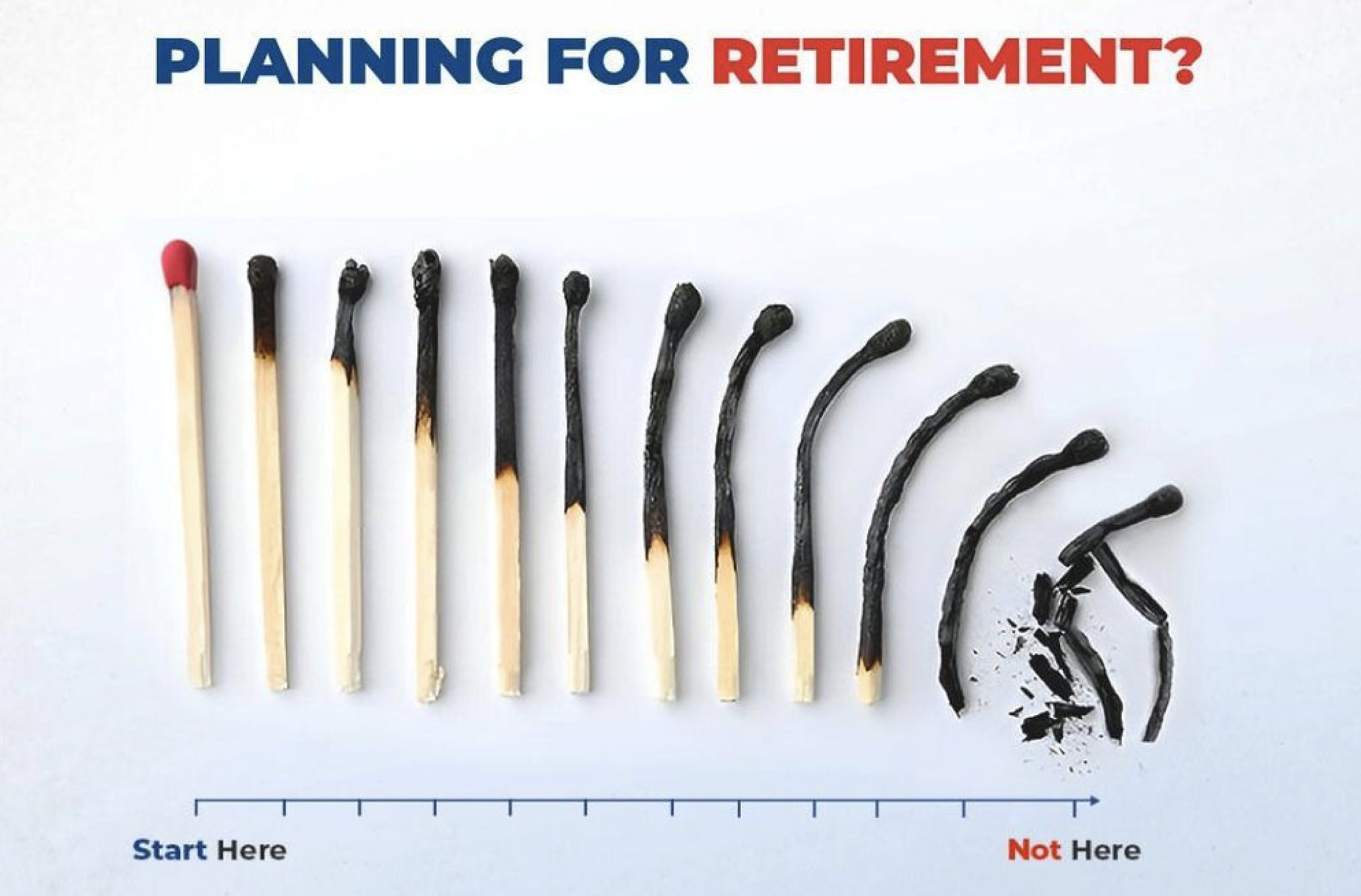

Our career is like a matchstick. When we’re fresh out of college and looking for our first job, it’s like a brand-new stick—intact, full of potential, ready to light up. The moment we step into our first job, it’s as though we’ve struck the match. The stick starts burning, its flame bright and steady. But, as with every matchstick, there’s a catch: the fire doesn’t last forever.

If we’re not mindful of how we use this flame, we risk running out of time. One day, the matchstick will burn out completely, leaving behind ashes. And if we haven’t planned and saved enough for retirement by then, we might find ourselves in deep trouble.

The Burning Matchstick: Limited Time, Irreplaceable Resource

The matchstick’s flame is a powerful analogy for our working years. Just as a matchstick has a finite length and burns down with time, our careers have a limited active earning period. We typically begin working in our 20s or 30s, and by the time we reach our 60s, the flame begins to dim as we step into retirement.

The critical lesson here is this: the flame doesn’t pause. Time keeps moving, and every passing year represents a portion of the matchstick burned. That’s why it’s essential to use the flame wisely—to illuminate a path toward a secure and dignified retirement.

Why Align Retirement Planning with the Matchstick of Life

Imagine holding a burning matchstick and failing to light the candles around you. Once the matchstick burns out, the opportunity is gone. Similarly, if we don’t start saving and investing for retirement early in our careers, we risk reaching the end of our working years without having lit the “candles” of financial security.

Retirement planning is not a luxury; it’s a necessity. Without sufficient savings and investments, we might find ourselves dependent on others, struggling to maintain our lifestyle, or unable to meet basic needs. The matchstick metaphor reminds us that our career flame is a one-time opportunity to build the foundation for our future.

The Consequences of Inaction

When the matchstick burns out and nothing has been prepared, the consequences can be dire.

Financial Dependence: Without adequate retirement savings, we might have to rely on family members or government support, limiting our independence.

Compromised Lifestyle: After decades of working hard, wouldn’t it be heartbreaking to reduce your standard of living during retirement?

Missed Dreams: Retirement is the time to pursue passions, travel, or spend quality time with loved ones. A lack of financial security can turn this dream into a struggle.

The truth is simple: ignoring retirement planning is like letting the matchstick burn aimlessly. The flame’s potential is wasted, leaving nothing behind but regret.

Lighting the Way: Actionable Steps for a Bright Retirement

To make the most of the flame while it burns, here are some key steps:

Start Early: The earlier you begin saving and investing, the more time you give your money to grow. Compounding is your best friend, especially when you start in your 20s or 30s.

Save Consistently: Set aside a portion of your monthly income for retirement. Treat it as a non-negotiable expense.

Invest Wisely: Relying solely on savings accounts isn’t enough. Consider investing in diversified portfolios—mutual funds, stocks, or other assets—to generate higher returns over time.

Plan for Inflation: The value of money decreases over time. Ensure your retirement corpus accounts for inflation so you can maintain your lifestyle.

Review and Adjust: Regularly review your retirement plan to ensure it aligns with your goals, life changes, and market conditions.

A Bright Future Awaits

As the matchstick burns, the flame offers us a chance to create something beautiful—a secure, fulfilling retirement. But this requires intention, planning, and action. Don’t wait until the flame is nearly gone to think about your future. Instead, take steps today to ensure that when the matchstick finally burns out, it leaves behind a legacy of light and warmth.

The time to act is now. Use your matchstick’s flame wisely, and you’ll create a retirement worth looking forward to.

👉 Book a free consultation with us at WealthWisher.in and build a solid game plan for your retirement phase.

Join Our Mailing List

Once Weekly Webinar

Free Webinar Once Per Week

Our free webinar runs once per week and is available to anybody who wants to know more about getting started on the road to financial freedom.