Every thoughtful investor faces this sooner or later — you sit down to plan your life goals, list them out honestly, put realistic cost estimates against each, calculate the monthly savings required… and the number stuns you.

It’s far higher than what you can currently save.

You’re not alone.

Many working professionals — even high earners — feel the same jolt of disbelief. “How can I possibly save this much every month?” The natural instinct is to either reduce the ambition or, worse, abandon the planning altogether thinking, “It’s pointless. I’ll never be able to manage this.”

But here’s a comforting truth: that overwhelming feeling isn’t a red flag — it’s proof that you’re taking your future seriously.

Why This Happens: The Weight of Ambition

Just last week, I was sitting with a client — a mid-career professional in his late 30s — planning out some key life goals. We weren’t being extravagant, just practical and hopeful. He wanted to send his daughter abroad for higher education and, in the next 5 years, buy a spacious flat in a good locality. Together, we ran the numbers.

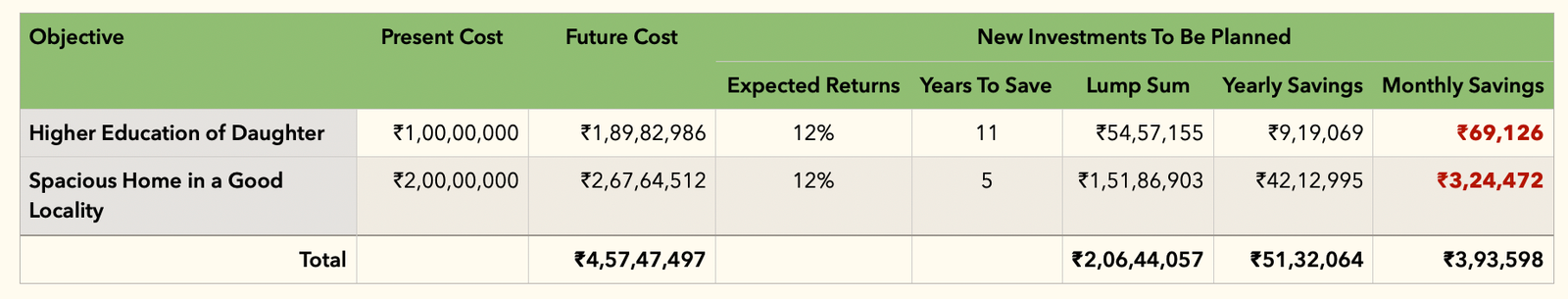

The education goal stood at ₹1 crore today — but when we adjusted for inflation over the next 11 years, the future cost shot up to nearly ₹1.9 crore. The flat, valued at ₹2 crore today, would likely cost around ₹2.7 crore in 5 years. We assumed a 12% return on investments and worked out the savings needed.

That’s when the real shock came:

He would need to invest over ₹3.9 lakhs every month to fully fund both goals — far beyond what he could spare today.

He looked at me, half-smiling, half-shaken.

“Is this normal? Am I aiming too high?”

The answer I gave — and the one I want to share with you — is this:

This is expected. If you plan your goals sincerely — allocating full costs, inflation-adjusted, in today’s terms — you might find the monthly SIP requirement to be uncomfortably high.

But this only means you’re dreaming big, and that’s okay.

Life is meant to be rich in experience, and money is the enabler.

What matters next is how we respond.

Step One: Don’t Quit Before You Start

Let’s acknowledge the emotional reaction first.

It’s easy to feel dejected when the numbers seem unachievable. But don’t fall into the trap of binary thinking — “If I can’t save the full amount, there’s no point saving at all.”

Even partial preparation makes a huge difference.

Saving ₹60,000 per month is better than saving none, even if your goal says ₹3.9 lakh is needed. Over time, income will rise, and you’ll be able to stretch, step up, and deploy windfalls wisely.

Step Two: Revisit the Timeline & Scope

Some goals are negotiable — others are not.

-

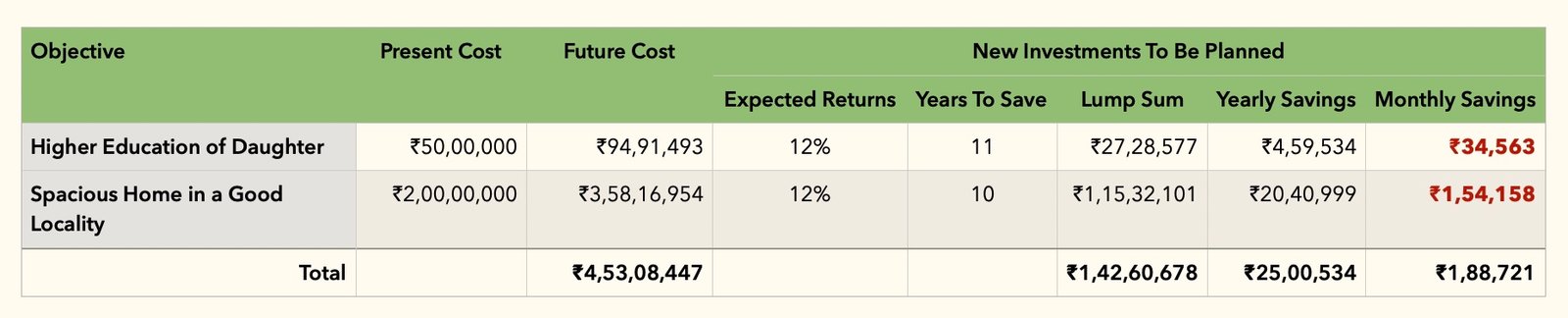

Buying a home? Consider delaying it by 8–10 years. Rent and save in the meantime.

-

Planning to retire at 50? Maybe 55 still allows you a restful life with better readiness.

-

Child’s education? This one is time-bound. But even here, you can explore cost-effective options: a reputable Indian university or a hybrid plan (self-funding + education loan) instead of fully self-funded overseas education.

A ₹2 lakh/month drop — made possible by tweaking priorities: opting for an Indian degree or a loan-backed education instead of fully self-funding, and pacing the housing goal wisely. The vision stayed just as big.

Be ambitious — but flexible.

Step Three: Use Your Income Growth to Your Advantage

Your income won’t remain static. As it grows, so should your savings.

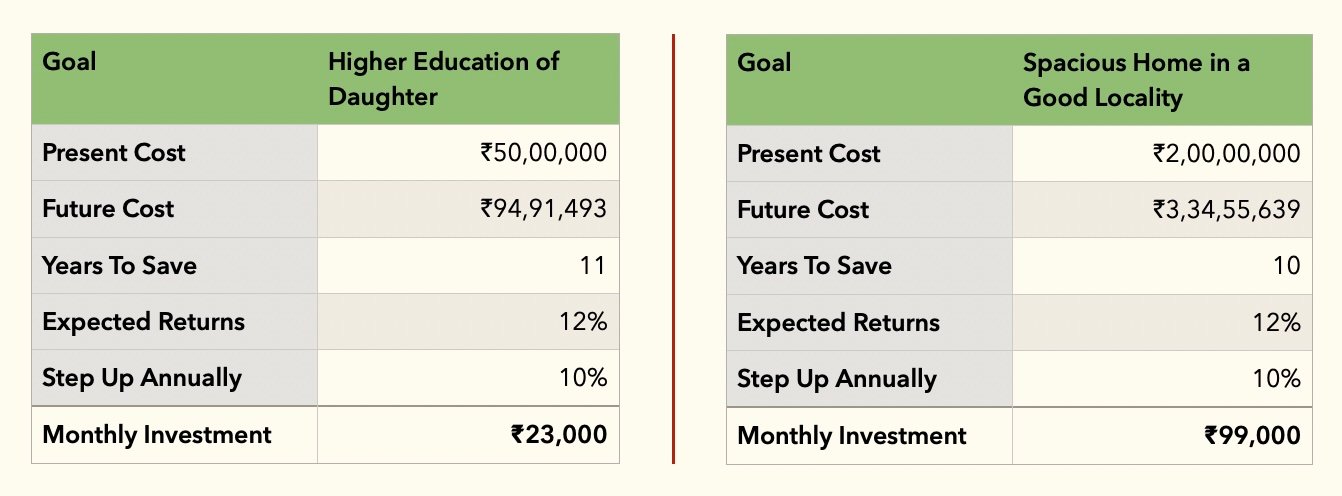

Introduce step-up SIPs — increase your investment amount annually in line with appraisals or promotions.

A 10% increase in monthly savings every year can do wonders to bridge the initial shortfall.

🎯 That’s over ₹2.7 lakh/month lower than the original plan — just by growing your investments as you grow in life.

Don’t ignore lump sum opportunities like bonuses, RSUs, gifts, or even inheritances. Assign these strategically to high-priority goals.

Step Four: Choose the Right Investment Vehicle

If your monthly saving capacity is tight, your investment efficiency must go up.

Relying solely on fixed-income products won’t get you there. Instead, channel your savings into well-chosen equity mutual funds aligned with each goal’s timeline and risk profile.

The risk of not taking risk is real — and greater than the risk of market volatility.

For example:

-

Retirement (15–20 years away): mid or small mutual funds

-

Child’s education (8–10 years): flexi-cap or multi-cap funds

-

House purchase (5–7 years): large-cap or dynamic asset allocation funds

Planning Is a Journey

Don’t turn your financial planning into self-punishment. A movie night, weekend dinner, or annual vacation keeps you going and helps you stick to your plan longer.

Don’t let big dreams scare you. Let them inspire a better plan.

Start saving, stay flexible, adjust as you grow — and your goals will begin to feel real, not remote.

💬 Need help navigating this? Book a 1-on-1 session

Join Our Mailing List

Once Weekly Webinar

Free Webinar Once Per Week

Our free webinar runs once per week and is available to anybody who wants to know more about getting started on the road to financial freedom.