Estate planning is not just for the ultra-wealthy. If you own a house, have mutual fund investments, a PPF account, or even a savings account with a nominee — this concerns you. Without proper planning, even well-meaning families can fall into long legal delays and bitter disputes.

In this article, we explore the two most important estate planning tools — Wills and Trusts — and help you decide which is suitable for your situation.

📝 What is a Will?

A Will is a legal document through which you specify how your assets will be distributed after your death. It includes:

-

List of assets and their distribution

-

Appointment of an executor (to carry out your wishes)

-

Names of beneficiaries

Key Features of a Will:

-

Easy and inexpensive to create

-

Can be handwritten or typed (registration is optional but recommended)

-

Can be changed or updated anytime

-

Cost: ₹2,000–₹10,000 (via lawyer or DIY kits)

🏦 What is a Trust?

A Trust is a legal arrangement where you (the settlor) transfer assets to a trustee, who holds and manages them on behalf of beneficiaries.

Key Features of a Trust:

-

More suitable for large or complex estates

-

Can be set up during your lifetime (living trust) or post-death (testamentary trust)

-

Helps bypass probate

-

Private, unlike Wills which may become public

-

Cost: ₹25,000 to ₹1 lakh+ depending on complexity

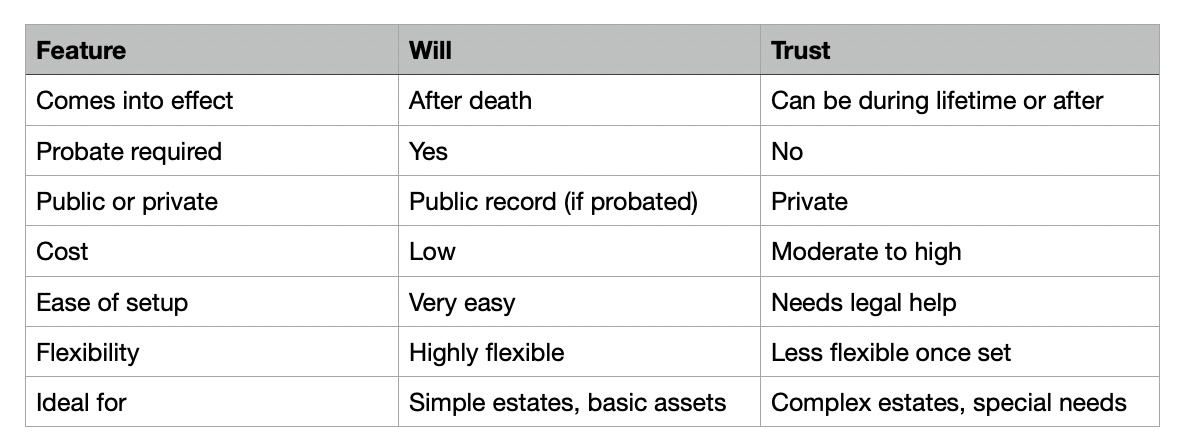

📊 Will vs. Trust: Side-by-Side Comparison

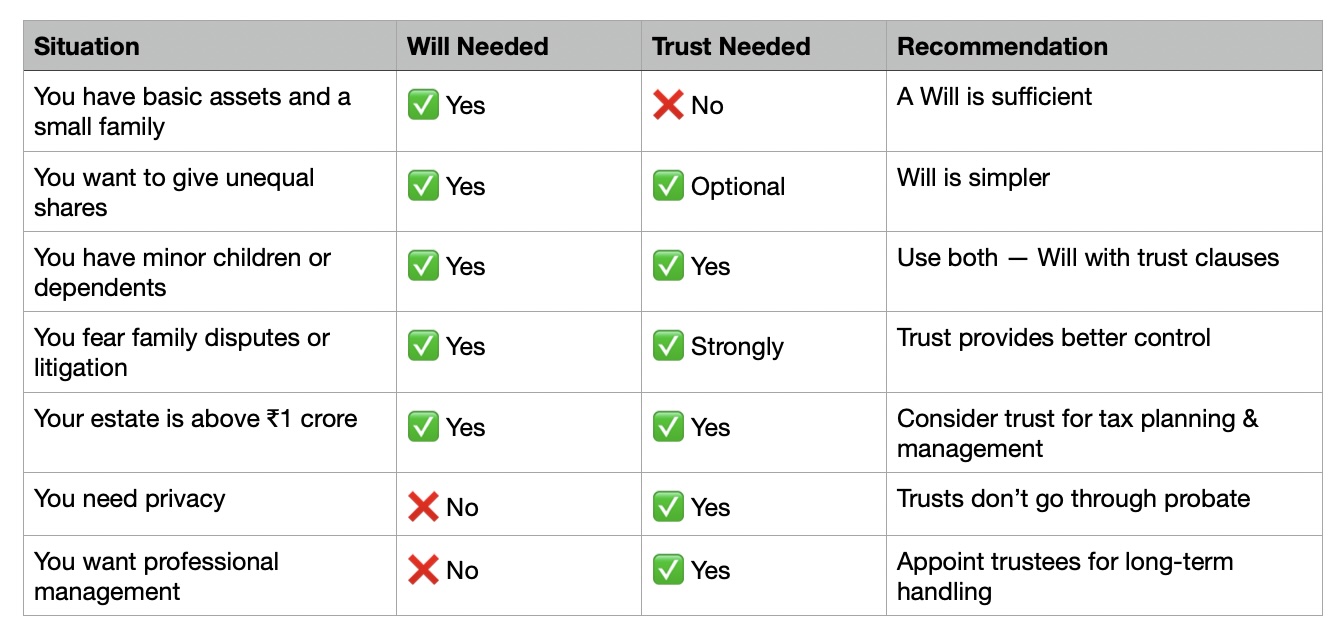

🤔 When Should You Use a Will or a Trust?

🧠 Key Takeaway

If your assets are straightforward — house, bank FDs, mutual funds — a Will is enough. But if you foresee complications, own a business, or have special dependents, a Trust is worth the extra cost.

✅ Action Points

Start by writing a Will — even a basic one is better than none.

Review your nominees — make sure they are updated across all accounts.

If you have > ₹1 crore in assets or expect disputes, consult a professional about setting up a trust.

“Don’t wait for a medical emergency to realize you should have written a Will. Do it now, peacefully.”

Stay tuned for Part 2 where we’ll guide you asset-by-asset — from bank accounts to EPF and mutual funds — and tell you exactly what happens after you’re gone.

Join Our Mailing List

Once Weekly Webinar

Free Webinar Once Per Week

Our free webinar runs once per week and is available to anybody who wants to know more about getting started on the road to financial freedom.