On our roads, we often see traffic advisories that say “Better Late Than Never.” And rightly so—being half an hour late is far better than driving rashly and ending up in a hospital or worse, never reaching your destination at all.

But does this wisdom apply everywhere in life? Especially when it comes to money and your financial goals? Let’s think about it.

When Being Late Is a Disaster

Would you, as a parent, be comfortable telling your son or daughter to wait one full year after completing Class 12 just so you could accumulate the college admission fees?

Or, would it be practical to postpone an important surgery or medical treatment simply to build savings first?

Or, would you really be okay with delaying your retirement by a few years because you didn’t accumulate the required corpus in time?

I guess not.

Some things can wait—a vacation, a new car, or even buying the latest gadget. But education, healthcare, and retirement arrive on schedule whether you’re ready or not. Unlike a road journey, you don’t always have the option to delay life’s milestones.

As Benjamin Franklin once said,

You may delay, but time will not.

And in personal finance, time is the single most powerful factor that determines how comfortable—or stressful—your journey will be.

The Cost of Being Late: A Relatable Story

Think of financial planning like driving on a highway. If you plan your trip early, check your fuel, and pace yourself well, you’ll arrive on time without stress. There’s no need to overspeed or take risky shortcuts.

In the same way, starting your investments early—even with modest amounts—allows compounding to do the heavy lifting. With returns that beat inflation by just a small margin, you can comfortably achieve your goals.

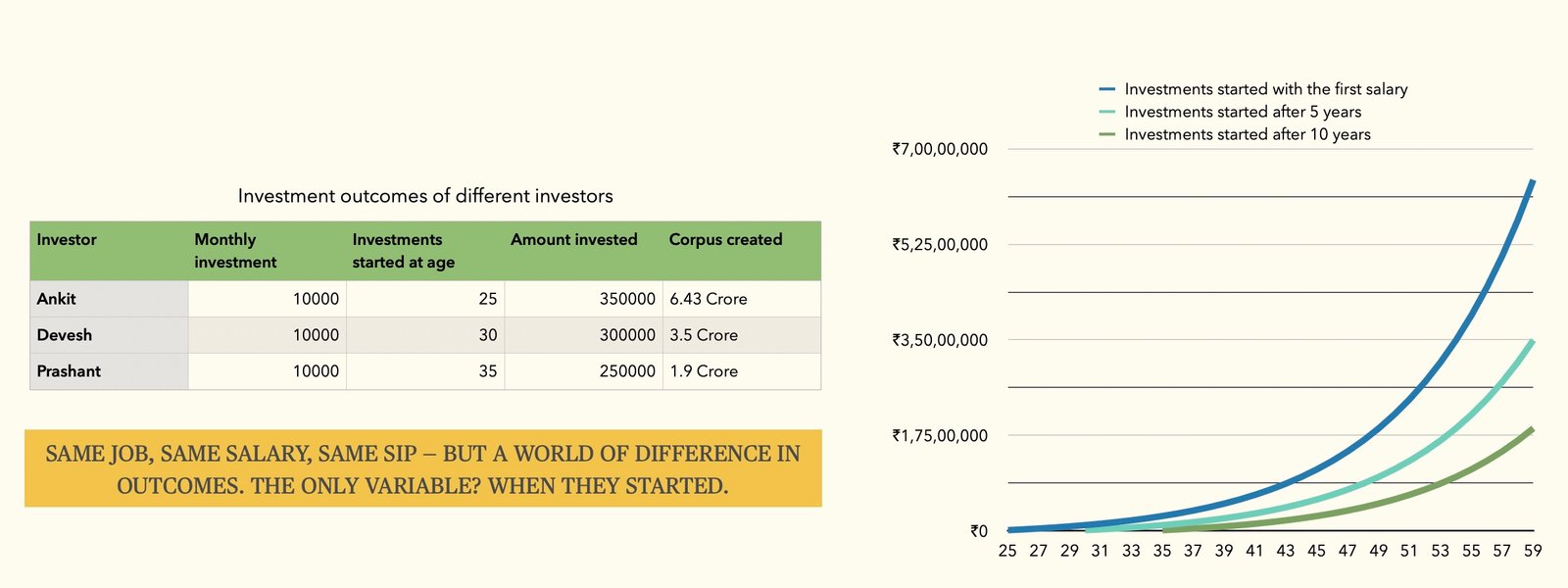

Imagine three friends—Ankit, Devesh, and Prashant—who graduate from the same MBA college and land jobs at the same consulting firm through campus placement. Their salaries are more or less similar, their lifestyle choices overlap, and they even share the same apartment for the first couple of years.

But when it comes to investing, their timelines differ.

-

Ankit starts early, right at age 25, by setting aside ₹10,000 every month into an equity mutual fund. He continues this habit steadily till retirement. By the time he turns 60, his total contribution of just ₹3.5 lakh grows into a whopping ₹6.43 crore.

-

Devesh decides to postpone. He thinks he’ll save better once his salary increases. He finally begins at 30, with the same ₹10,000 per month. His total investment of ₹3 lakh grows to ₹3.5 crore—nearly half of what Ankit built.

-

Prashant pushes it even further. Busy with EMIs and lifestyle upgrades, he starts only at 35. Despite investing ₹2.5 lakh over time, his corpus grows to just ₹1.9 crore.

Same college, same job, same salary, and the same monthly investment—but vastly different outcomes. Why?

This is the invisible “late fee” in personal finance. The later you begin, the more compounding you sacrifice. And once lost, those years can never be recovered.

The Takeaway

“Better Late Than Never” may save lives on the road. But when it comes to money, the real wisdom is: “Better Early Than Late.”

Start today, pace yourself, and let time and discipline guide you safely to your destination

👉 Are your finances on track for your child’s education, your retirement, or unforeseen emergencies? At WealthWisher, I help families plan early so they never have to choose between rushing dangerously or arriving too late.

👉 Book your free 1:1 financial planning session here → https://wealthwisher.in/book-a-call/

Join Our Mailing List

Once Weekly Webinar

Free Webinar Once Per Week

Our free webinar runs once per week and is available to anybody who wants to know more about getting started on the road to financial freedom.