Most people preparing for CAT, GMAT, or an MBA abroad assume they must memorise the entire English dictionary.

It sounds heroic — 10,000 words, 1,000 pages, endless mugging.

Then someone tells them:

“Relax. You don’t need the whole dictionary.

Just 1,500 high-frequency words.”

Suddenly, the mountain becomes a molehill.

Break it into six months:

-

1,500 words ÷ 6 months = 250/month

-

≈ 8 words per day

Eight words.

That’s it.

A cup-of-chai effort.

Now look at the kind of words MBA aspirants learn:

bene (good), mal (bad), anthro (human), phil (love), anti (against), auto (self), graph (write), bio (life), geo (earth)

Nine tiny roots that unlock hundreds of big words — benefit, malice, philanthropist, autobiography, biography, geology, and so on.

Small inputs.

Massive outcomes.

But here’s the hidden lesson:

the magic lies not in the complexity of the words,

but in the consistency of learning them.

When Vocabulary Teaches You the Real Cost of Delay

Let’s assume the aspirant wants to learn all 1,500 words in six months.

Scenario 1: Stays consistent

8 words/day → smooth, effortless progress.

Scenario 2: Skips 1 month

Now there are only 5 months left.

= 300 words/month → 10 words/day

Still okay.Scenario 3: Skips 2 months

4 months left.

= 375 words/month → 12–13 words/day

Noticeably heavier.Scenario 4: Skips 3 months

3 months left.

= 500 words/month → 17 words/day

Double the original load.

The goal hasn’t changed.

The effort has exploded.

The math is simple.

The insight is powerful.

Every month you delay, the monthly load goes up.

Every quarter you delay, it multiplies.

And Now… The Money Lesson Hidden in These Roots

This is exactly how investing works.

Whether your goal is:

your child’s education,

your own retirement, or

a debt-free, peaceful life…

…the target remains the same.

But the cost of reaching it changes depending on when you start.

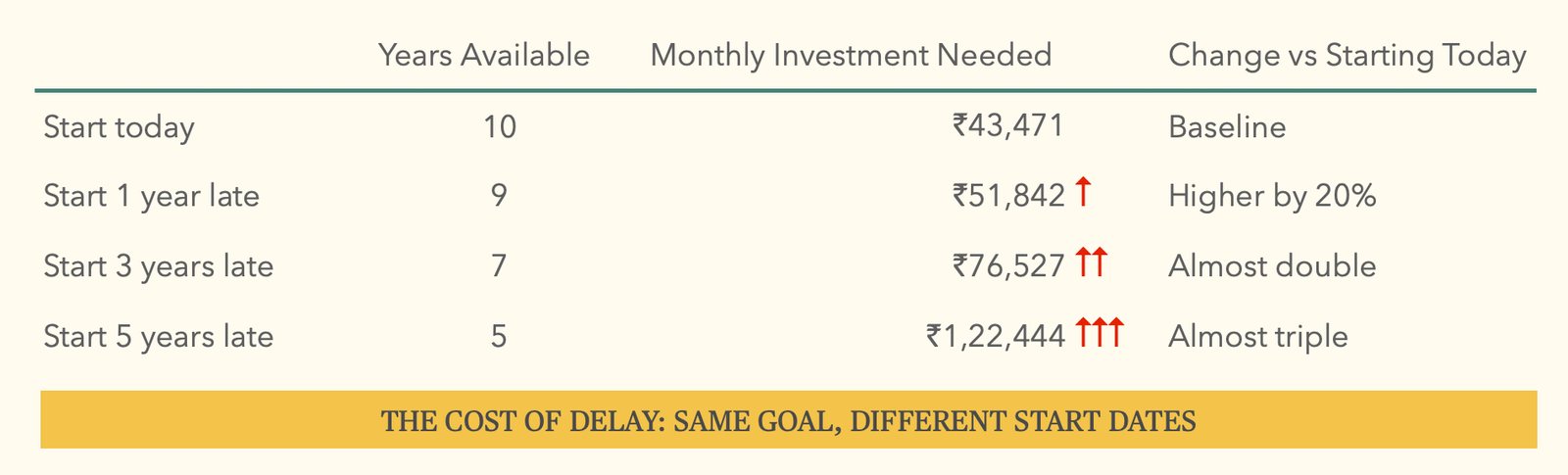

The table below shows the cost of delay for a simple, familiar target — ₹1 crore.

Note: The numbers above are illustrative, assuming a long-term return of 12% per annum. Actual returns may vary. This example is meant to explain the impact of delay, not to predict future outcomes.

Start today, with time on your side, and the monthly effort feels manageable.

Start just one year late, and the same goal already demands a noticeably higher commitment.

Delay by three years, and the monthly investment almost doubles.

Push it by five years, and the effort climbs to nearly three times the original amount.

The goal didn’t change.

The return assumption didn’t change.

Only the time did.

And that single change quietly multiplied the monthly effort.

When time is on your side, effort feels light.

When time is lost, effort doubles silently.

When you delay long enough, the climb becomes steep.

The future cost isn’t visible on day one.

The pain arrives later — when there’s less time left to catch up.

The Roots of Words vs. The Roots of Wealth

Bene means good.

And the best bene-fit you can give yourself financially is starting early.

Mal means bad.

And one of the most mal-efic decisions is waiting “for the right time.”

Phil means love.

If you truly phil your family, invest early for their goals.

Auto means self.

Your future depends on auto-mating your SIPs, so life doesn’t get in the way.

Geo means earth.

And on this geography of life, the earlier you start, the smoother your financial journey becomes.

These tiny roots unlock complex words.

And tiny habits unlock lifelong wealth.

Consistency is Cheaper Than Procrastination

Whether it’s:

learning 8 words a day, or

investing regularly toward a long-term goal…

the principle is the same:

Small, early efforts feel almost invisible.

Skipping them makes the later effort painfully visible.

The MBA aspirant who skips vocabulary for a few months suddenly needs double the daily load.

The investor who delays investing for a few years ends up facing a sharply higher monthly commitment — as the table above clearly shows.

The formula is identical.

Only the subject changes.

Final Word

You don’t need the whole dictionary to crack an MBA entrance.

You need the right words — consistently.

You don’t need massive lump sums to build wealth.

You need the right habits — consistently.

Small roots build big words.

Small SIPs build big futures.

And both rely on one thing:

Start early. Stay consistent.

Let time do the heavy lifting.

Sometimes, the biggest financial decision is simply deciding to begin.

Join Our Mailing List

Once Weekly Webinar

Free Webinar Once Per Week

Our free webinar runs once per week and is available to anybody who wants to know more about getting started on the road to financial freedom.