A few days ago, I came across an ad that said:

“Buy now, pay later — zero interest for 12 months!”

These days, you can get a loan for just about anything — a phone, TV, washing machine, education, two-wheeler, car, home, even home improvement.

But did you ever ask a bank for a loan for your retirement?

Try it. You’ll be disappointed.

No bank, no lender, no financial institution will fund your retirement.

But don’t throw in the towel yet.

What if I told you there’s a way to get a regular flow of money every month after you retire — without paying a single EMI?

Sounds unreal? Let me explain.

When the EMI Stops, Life Shouldn’t

In our earning years, EMIs feel normal.

That familiar debit message every month means life is moving — we’re building something.

But the day income stops, that same debit message can become the most stressful notification.

Retirement flips the formula.

Instead of you paying EMIs, imagine life paying you — a credit in your account on the 1st of every month, just like salary day.

No loan documents.

No interest.

No repayment.

Sounds unreal? It isn’t.

It’s just called planning ahead.

How to Create Your “No-EMI Retirement Loan”

Here’s how life’s kindest equation works:

While you’re working, you invest ₹10,000 every month for 20 years.

At the end of those 20 years, your money starts returning the favour — paying you a steady ₹1 Lakh each month during retirement for the next 20 years.

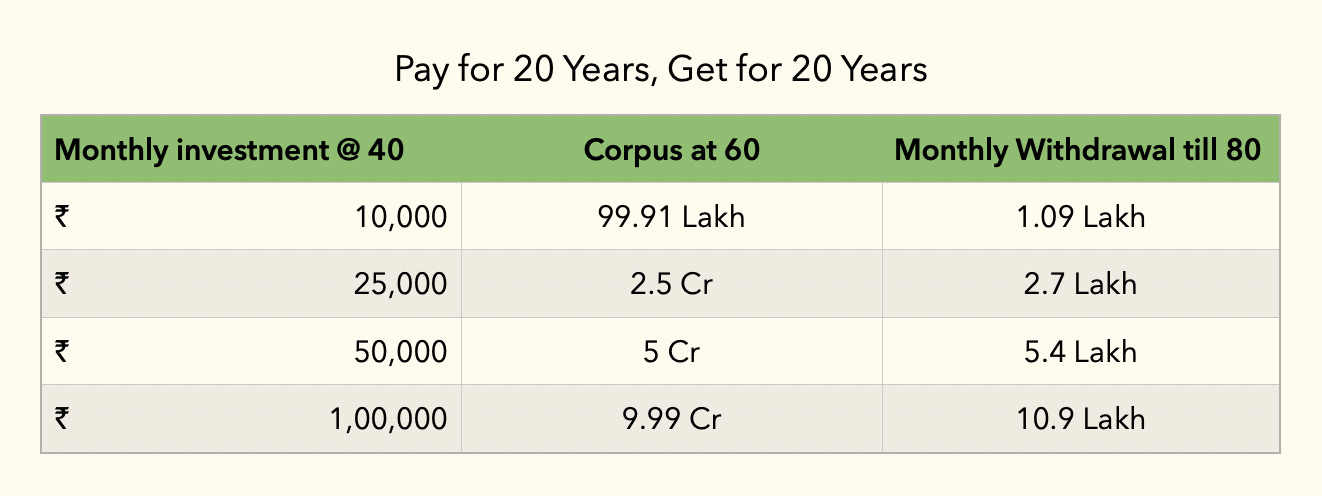

Let’s put numbers to this idea:

Illustration: How your monthly investment at 40 can fund withdrawals till 80.

*Returns assumed at 12% annually. Mutual fund investments are subject to market risks; please read all scheme-related documents carefully.

That’s your No-EMI Retirement Loan — you repay it during your working life, and receive it for the rest of your retired life.

No bank does this.

Your discipline does.

Your patience does.

Why the Banks Won’t Help — But You Can

A bank will happily lend you money for a car or a phone because those depreciate — and the bank earns interest.

But retirement isn’t a product. It’s peace of mind.

No financial institution will give you a loan for that. But your younger self can.

The only condition? Start early and stay consistent.

That’s the real creditworthiness life demands — discipline, not documents.

Be Kind to Life, and It’ll Be Kind Back

Life is surprisingly generous, but only if you’re kind to it first.

Every month that you invest, every expense you postpone for a purpose — it all adds up silently.

Years later, that kindness returns as security, confidence, and choices.

Because the real joy of retirement isn’t just freedom from work — it’s freedom from worry.

The Real Loan Worth Taking

A car loan gives you comfort.

A home loan gives you stability.

But a retirement loan — the one you fund yourself — gives you freedom.

So, start now. Pay your future self a small EMI each month.

Let compounding handle the rest.

Because someday, when the 1st of the month arrives and your account gets credited again — this time, without a job and without EMIs — you’ll smile knowing:

You took the smartest loan of your life.

And you never had to repay it.

👉 Want to know how much your “No-EMI Retirement Loan” can pay you each month?

Let’s crunch the numbers together.

Book a free 1:1 session at WealthWisher.in — and start building the retirement income that truly feels like freedom.

Join Our Mailing List

Once Weekly Webinar

Free Webinar Once Per Week

Our free webinar runs once per week and is available to anybody who wants to know more about getting started on the road to financial freedom.