A Real Story that Rekindled Conviction

Last week, while reviewing a new client’s mutual fund portfolio, one entry instantly caught my eye. An investment of ₹9,000 in DSP ELSS Tax Saver Fund had grown to ₹1,16,000.

Now, as someone who lives and breathes equity investments, I know such growth is possible. But seeing a real-life example like this — right in front of me — brought a genuine sense of joy and, more importantly, renewed my conviction in long-term equity investing.

Is This a Rare “Once in a Blue Moon” Case?

Not at all. Let me explain with real numbers.

This client had invested in the DSP Tax Saver Fund in September 2008, when the NAV was just ₹11.83. As of 5th September 2025, the NAV stood at ₹136.044. That translates to a 15.44% annualised return over 17 years — a tremendous journey of compounding.

Now, let’s put this in perspective. September 2008 was no ordinary time. It was the year of the Lehman Brothers collapse and the global financial meltdown. Our markets were already reeling under a bear grip, and the fall had further to go.

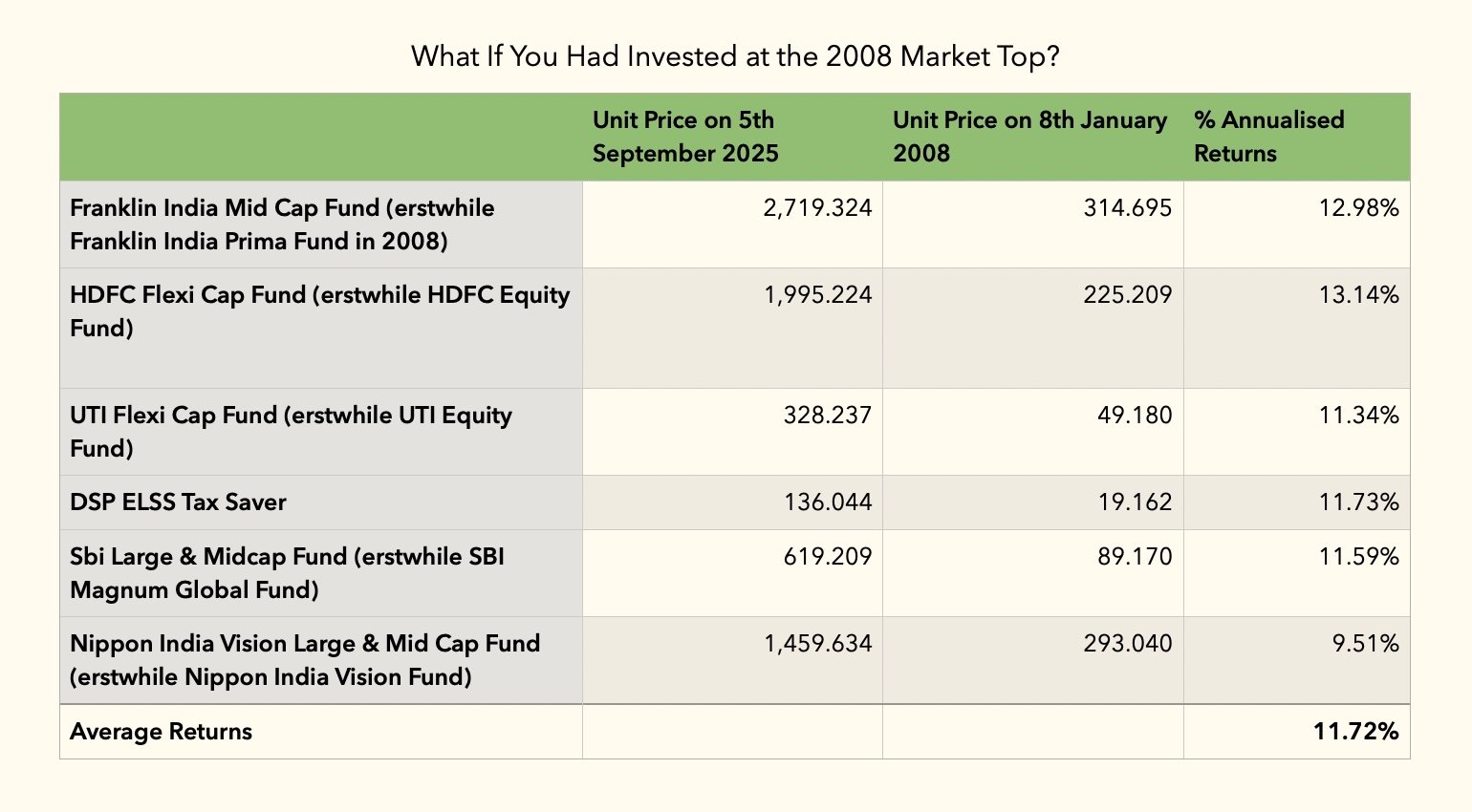

Let’s make it one-sided and even tougher. Instead of starting from somewhere in the middle, let’s measure from the peak. On 8th January 2008, the Nifty touched 6,357, the top of that ferocious bull run from 2003 to 2008. What if you had invested at that exact peak?

Here’s what some well-managed funds with a 20-year track record have delivered:

Even from the absolute top of one of the most rewarding bull phases in our history, good mutual fund schemes have continued to deliver around 12% annualised returns.

And what does that mean in simple terms? At 12% annualised growth, your money doubles every 6 years. That is the quiet but powerful magic of compounding at work.

The Hidden Gift of Section 80C

Interestingly, that original ₹9,000 investment in DSP ELSS Tax Saver Fund was most likely made with a different motive — to save taxes under Section 80C.

For years, 80C played a dual role: it gave immediate tax relief, but more importantly, it nudged people into the habit of saving and investing. A few years ago, when the Finance Ministry introduced the new tax regime and removed 80C deductions, the idea was to simplify taxes. The logic was: “Why force people to invest? Let them choose freely, since everyone understands the importance of saving.”

On paper, this sounds reasonable. But I stand with the second camp. In reality, working in good companies and earning high salaries does not automatically translate into financial literacy — especially in the early years of one’s career. For many, 80C was that gentle push which ensured they built assets instead of spending it all.

This indirect benefit — the habit of saving — may have created more wealth for Indians than the tax rebate itself. That ₹9,000 tax-saving investment is living proof.

Anyway, sorry for the little detour — let’s get back to our story.

The Classic Dilemma: Past vs. Future

Naturally, the next question arises:

“Isn’t this just the past? And don’t mutual fund houses themselves warn that past performance is not indicative of future returns?”

Well, spot on.

Here’s how I look at it: our understanding of the future rests largely on what the past has taught us. Ignoring history is like discarding humanity’s accumulated wisdom. As Mark Twain put it beautifully,

History doesn’t repeat itself, but it often rhymes.

This means we should neither blindly assume the future will look like the past, nor should we disregard the lessons it offers. What worked in the 1990s — investment themes, dominant companies, even entire industries — may not work in 2025. Many companies that once formed part of the Sensex no longer even exist. Change is the only constant.

The Role of a Financial Advisor

And that’s where the role of a financial advisor becomes critical. The advisor ensures that your ladder is not only tall enough — but also leaning against the right wall. Because wealth creation is not just about compounding numbers, it’s also about evolving strategies, choosing the right vehicles, and staying on course when markets test your patience.

Earlier, Section 80C nudged you to invest in order to save tax. In the new tax regime, that push is gone — which makes financial literacy and conscious investing more important than ever. If you want to build wealth purposefully and not just accidentally, let’s chart a plan together.

👉 Book your free 1:1 financial planning session here → https://wealthwisher.in/book-a-call/

Join Our Mailing List

Once Weekly Webinar

Free Webinar Once Per Week

Our free webinar runs once per week and is available to anybody who wants to know more about getting started on the road to financial freedom.